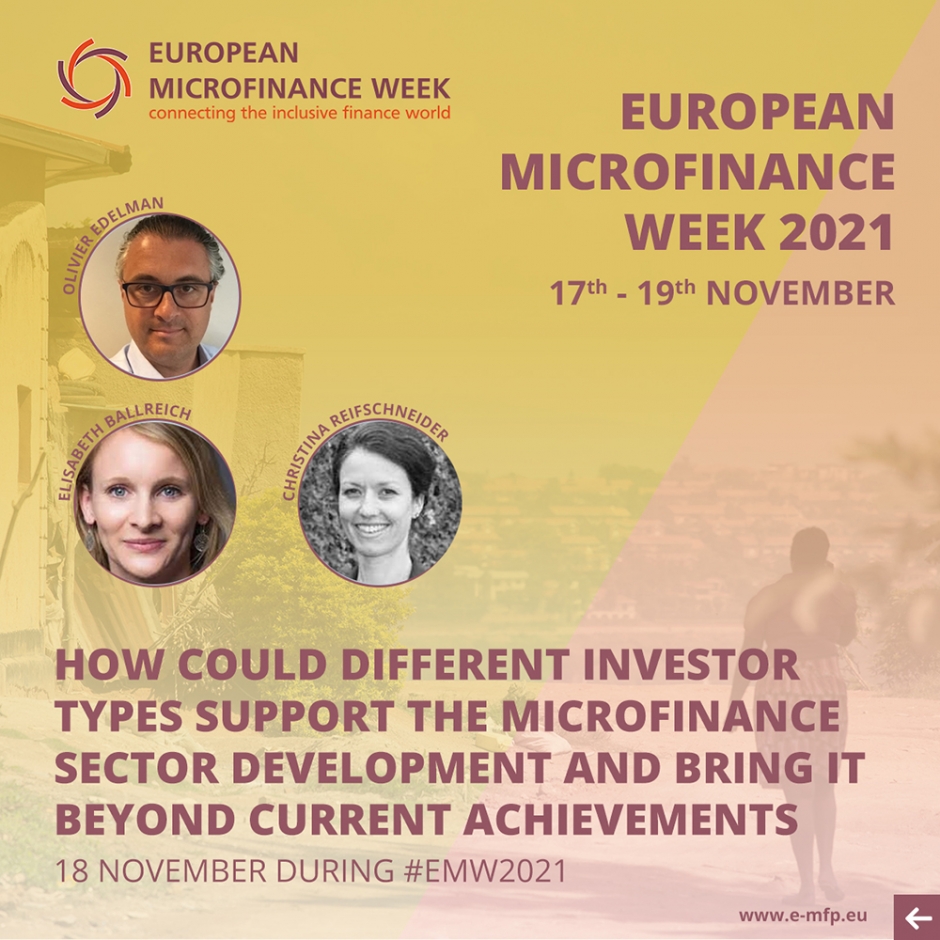

[PANEL SESSION] How could different investor types support the microfinance sector development and bring it beyond current achievements

- Olivier EDELMAN, EIB

- Elisabeth BALLREICH, WWB Asset Management

- Christina REIFSCHNEIDER, Baobab Group

INTRODUCTION

Today, microfinance institutions are very different compared to 20-30 years ago. Microfinance institutions are more stable, financially more robust and resilient. However, the financial inclusion agenda is still a work-in-progress. Financial exclusion still persists and the gap is sometimes substantial. Going forward, a joint commitment from all investors towards the microfinance sector must be to further deepen the reach of microfinance institutions. But, for this to happen, investors must improve their product offering to encourage and enable microfinance institutions reaching the most vulnerable. This will be a team effort and will require combining the capacity of all microfinance investors.

PRESENTATION

Olivier EDELMAN invited the speakers to introduce themselves. Elisabeth BALLREICH is a principal investment officer at Women’s World Banking Asset Management. They manage two private equity investment funds with the specific objective to improve financial services for women. Christina REIFSCHNEIDER is the Group CFO of Baobab, a microfinance group active in Africa and in China.

In turn, Edelman introduced himself as being in charge of EIB’s microfinance investment activities, which are taking place in Africa, MENA and the Caribbean, providing both debt and equity.

What brought the panel together is to discuss what could and should be done more, in the context of the following observations:

- MFIs have evolved and became more stable and resilient though some might still be constrained in their risk-taking capacity.

- Financial exclusion persists, financial inclusion has not been realised all over; the gap remains significant.

- Joint commitment is needed from all investors to further deepen the reach of MFIs to the most vulnerable people.

- And, a team effort is needed to combine the capacities of all microfinance investors, to provide dedicated financing, portfolio guarantees, and equity or micro-insurance solutions.

The question that was posed next concerned what different types of investors can suggest to address the aforementioned gaps. Ballreich started by explaining that 1 billion women lack access to financial products. WWB has worked for 40 years for inclusion of women, and its Asset Management invests in high performing, innovative financial service providers globally to increase women’s financial inclusion and empowerment. In the process microfinance institutions gradually evolved their retail emphasis from group to individual lending, and recently also digital lending was introduced.

During all that, WWB saw the industry evolving from non-profit to for-profit, which lead to relatively less women served and less women staff employed. That is why WWB decided to become not only a grant maker but also an equity investor, to ensure that its concerns are tabled at the board of directors of MFIs to prevent mission drift whilst becoming financially successful. At present it has two investment vehicles in the form of funds under management. They invest in high performing innovative financial service providers and ensure adherence to women and inclusivity objectives.

This takes form in a new way in WWB’s second Fund, which applies a blended finance strategy, bringing in different sets of capital, return expectations and risk profiles. This streamlining of the various types of capital with their respective return expectations in a layered or cascaded pattern of blending, allows the fund to go the extra mile and reach providers and clients that otherwise would remain short of financing. At the same time, it allows for strengthening gender strategies by supporting the way financial institutions serve women clients, and hire and retain the best female talent in the market. This strategy is slowly adopted more widely in the sector but the pace is indeed low as conventionally shaped investment strategies and return expectations cannot be changed overnight. This requires considerable educational work from the Fund’s end, as well as from likeminded institutions.

Edelman said he was struck by the level of dedication shown by WWB, and its capacity to transform that into investment-ready propositions. This balanced investment concept can perhaps also be applied to other groups not yet or not enough included.

Reifschneider next highlighted the Baobab Group’s investment in nine subsidiaries, nearly all in Africa, reaching 1.25 million clients with average loan amounts of EUR 3,300. Deposits stand at EUR 264 million and the loan portfolio at EUR 659 million. Incidentally, Baobab goes beyond microloans by providing SME loans. The scheme below visualises four investment areas in which the support of different investor types and donors is necessary to reach higher levels of inclusion:

- Developing digitalisation: grants and TA are welcome to pay for initial phases, product development, systems and increasing operational efficiency.

- Taking risk: portfolio guarantees, elevated credit risk levels and balanced return expectations would benefit from a more dynamic risk concept.

- Ensuring solid funding including commercial funding and liquidity guarantees, subordinate loans, financing in local currencies and provision of guarantees.

- Developing regulatory frameworks: appropriate for microfinance and following best practices in the sector, strengthening credit bureaus.

This way, different categories of investors can recognise areas they would feel comfortable with, or competent in. Bringing that together is the key characteristic of blended finance, allowing for managing mixed return expectations.

Edelman mentioned that the EIB could take up some of these considerations (in fact they are doing so already), provided they continue investing at market terms. They also see the emergence of new investment areas such as health and climate insurance, as tools that could help go the last mile by strengthening resilience strategies. This indeed requires the forging of new forms of cooperation between different categories of investors. That is new and yet a bit unusual, but promising nonetheless as can be learned from WWB and Baobab.

Some questions were then formulated, for instance whether such blended structures could handle big investment tickets of e.g. at least EUR 100 million. This was considered possible through consolidation, networking and affiliation at the investee side, but may not necessarily be the main way to go as ‘big ticket providers’ usually ignore niche markets such as theirs. But this may evolve in blended set-ups. A second question pointed to micro-insurance as a rapidly maturing new investment area. In this respect, reference was made to ILO’s www.impactinsurance.org for more information.

The quintessential call for action from the panel was to urge current and potential investors in the microfinance sector to support the introduction of new investor partnerships, structured to meet typical second needs with regard to capital intake that may result from delivering on the inclusion pledge. The two cases presented essentially provide a roadmap ready for that purpose.