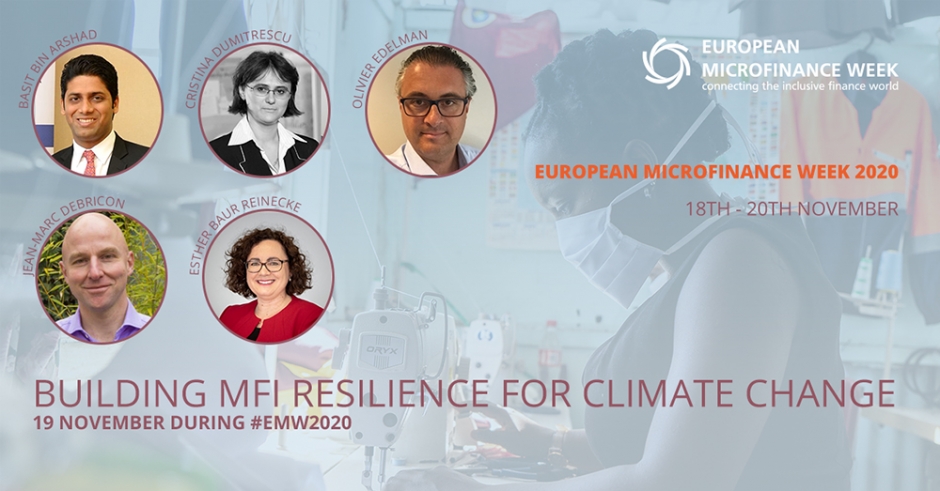

[Working session] Building MFI resilience for climate change

- Olivier EDELMAN, European Investment Bank (EIB)

- Basit BIN ARSHAD, BlueOrchard Finance Ltd

- Cristina DUMITRESCU, EIF

- Jean-Marc DEBRICON, Alterfin

- Esther BAUR REINECKE, Swiss Re

INTRODUCTION

Climate change poses enormous threats to vulnerable clients, but also to institutions serving them. This working session will discuss what real measures investors could take to increase the resilience of institutions, with particular examples of innovative risk sharing or insurance models.

PRESENTATIONS

Olivier EDELMAN, opened the session by welcoming and introducing the panellists. He highlighted the consequences of climate change, in particular for vulnerable populations in low-income countries. Edelman then explained how EIB supports sustainability transition, with a strong focus on inclusiveness and building climate change resilience for vulnerable communities.

Jean-Marc DEBRICON from Alterfin presented the approaches of Alterfin’s partners to build institutional resilience to climate change. Partner MFIs have implemented capacity-building activities for climate change adaptation through diversification of agriculture, and they have adapted their portfolio and products. MFIs recognise the mutual interdependence between their own resilience and that of their clients. Debricon also explained Alterfin’s efforts with respect to their lending approach, and the technical assistance to build capacities of MFIs and their clients to respond and adapt to external shocks. He stressed that in order to adequately respond to the magnitude of climate change threats, partnerships must be built with the private and the public sector.

Cristina DUMITRESCU presented the EaSI (Employment and Social Innovation) Financial Instruments that are implemented by the EIF on behalf of the European Commission. Its objective is to improve the availability of, and access to finance for vulnerable groups. She explained that MFIs need to be protected against the credit risks that lending operations to the vulnerable borrowers entail. EaSI Financial Instruments consist of three components: the EaSI guarantee instrument, the EaSI Capacity Building instrument, and the EasI Funded instrument. Together with strengthening the capital base and liquidity of MFIs, capacity building activities are expected to result in improved risk management systems able to better assess the risk profiles of their clients.

Esther BAUR REINECKE from Swiss Re discussed how insurance can protect MFIs against risks, and enable their clients to access credit with insurance as collateral. She illustrated how agricultural insurance mitigates risk associated with agriculture, thus enabling access to loans, with an example of a partnership with Syngenta in Kenya. Baur Reinecke continued to present the insurance interventions for MFIs and government schemes, which incentivise lending to previously excluded beneficiaries that are particularly vulnerable to the impact of climate change. MFIs can protect their portfolio by receiving an insurance pay-out in case of extreme weather events in disaster-prone areas. Government insurance schemes facilitate access to credit for mainly the agricultural sector, as this is sector is most vulnerable to climate change. Challenges that need to be dealt with are affordability and scalability, both of which require partnerships to create the necessary infrastructure.

Basit BIN ARSHAD elaborated on BlueOrchard’s IIF fund, which offers new insurance solutions, consisting of loan and insurance components, for underserved communities in emerging markets. The scheme is promoted by BlueOrchard and the public sector through a technical assistance facility and a premium support facility, to educate clients on the products and their benefits, and drive the outreach. The subsidised premium ensures that the insurance is affordable for the bottom-of-the-pyramid. According to Bin Arshad, one of the hurdles for implementation is the lack of technology needed to identify the thresholds for insurance in terms of weather data.

DISCUSSION

The discussion first revolved around how inadequate funding in terms of hard currency exposes the MFI to risks. Moreover, when the portfolio risk increases, lenders are not committed to support the borrowers. Responsible lending is critical to building MFI resilience to climate change. Next, the floor discussion turned to portfolio covers that provide liquidity for MFI. A climate guarantee facility for MFIs could stimulate them to reach the goal of increasing access to credit in disaster-prone areas. Then, the rising cost of insurance was discussed. Subsidies from DFIs and government are critical to ensuring the affordability of insurance.

Edelman concluded the session by acknowledging that a combination of different solutions, as presented during this session, is required to manage and anticipate climate risks for MFIs, such as:

- Lending needs to be adjusted to the local context, to ensure qualitative and affordable loan products that meet the needs of MFI beneficiaries.

- Capacity building of target beneficiaries requires technical assistance, comprising both financial and non-financial products, and with appropriate risk management and governance mechanisms.

- Innovative climate insurance models and guarantee schemes can play an important role in protecting lending operations against credit risks in disaster-prone areas. This will stimulate access to credit for clients in areas vulnerable to climate change.